Park Hill Financial Empowerment Program

Park Hill Financial Empowerment Program 2020

Northeast Park Hill is experiencing a systemic economic crisis that requires an urgent human-centered response by and for the community.

Background

Purpose:

To spread financial knowledge and resources through the influence of trusted community members in the Park Hill community to enhance the financial abilities of individuals and small businesses.

Call to action:

From 2019 Park Hill Talks, PHCI heard a call to action for culturally relevant financial empowerment in; Budgeting/Accounting, Personal/Business banking, Building/Maintaining good credit, Managing personal/business debt, Raising personal income/business capital, First-time home buying, Community wealth, and Estate/Inheritance planning. As a result, PHCI convened a group of individuals who Live, Learn, Work, Play, or Worship in Park Hill as an action committee.

Challenges:

Based on the data, Northeast Park Hill is experiencing a systemic economic crisis that requires an urgent human-centered response by and for the community. This is due, in part, to the following root causes: 1) Stigma - Social stigma surrounding financial literacy prevents local, small business owners and community members of Northeast Park Hill from gaining financial stability and success; 2) Training and Resources - Financial education training and resources are not readily available or relevant to local, small business owners and community members of Northeast Park Hill; 3) Financial Products/Services - Local, small business owners and community members of Northeast Park Hill are not provided with financial opportunities by traditional financial institutions due to perceived high risk.

Research:

Research suggests that financial empowerment through train-the-trainer models geared at mediating individual behavioral change through the influence of interpersonal, organizational, and community environments have sustained success in communities like Park Hill.

Strategy:

Through the Train-the-Trainers model, experts will provide basic training to trusted community members on financial concepts, on how to coach, and will provide additional resources for referrals. The trainees will then apply that knowledge in supporting small business owners and community members who live, learn, worship, work, or play in Park Hill.

Modality:

Online, live, video meetings through Google Hangouts. Sessions will be recorded and made available for any participants who are unable to attend live.

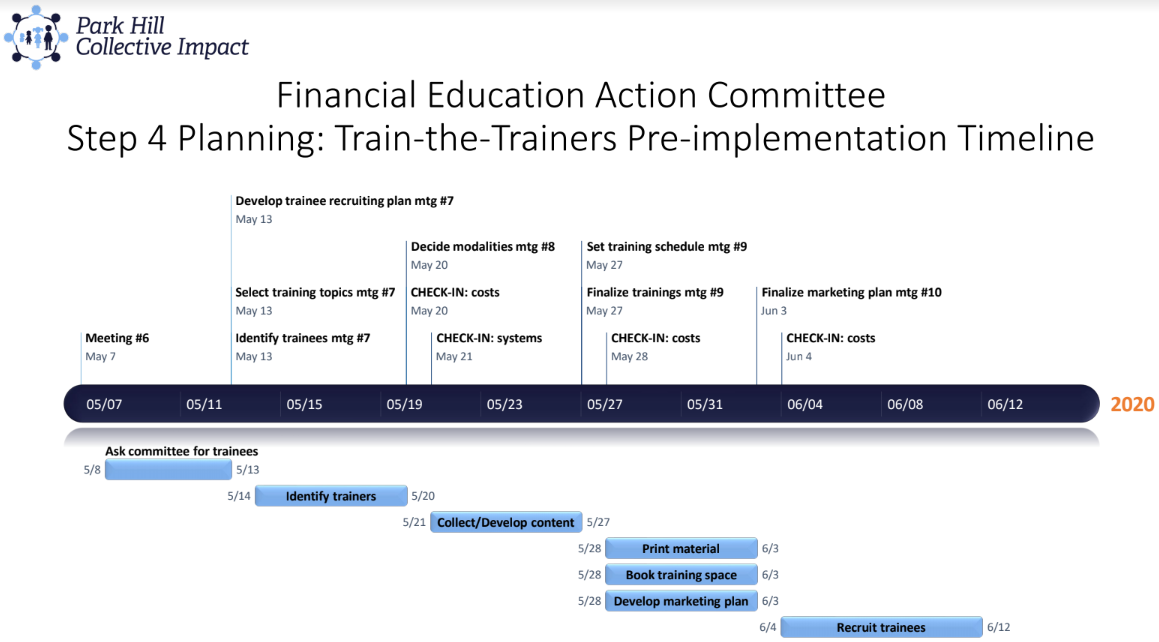

Timeline:

Weekly, 5:30 - 6:30 PM, beginning Wednesday, August 12, 2020 and ending Wednesday, November 25, 2020.

End Users:

Families, small businesses, and community members who live, learn, worship, work, and play in Park Hill.

Action Committee Members:

Action committee members consist of individuals who Live, Learn, Work, Play, or Worship in Park Hill. This work will have a collective impact, by and for the community, with the shared vision to create A Community That Is Thriving, Not Just Surviving.

Brianna Benevides, Heart and Hand Center

Joseph Dominguez, Love Thy Neighbor

Jessica Dominguez, Love Thy Neighbor

Narcy Jackson, Athletics and Beyond

Olivia Lincoln, Heart and Hand Center

Rashon Manning, FirstBank

Danny Martinez, APEX Business Consulting

Patricia Ochoa, DPS PREP Academy High School

Justin Petaccio, resident and Spire Financial

Cordelia Randall, CrossPurpose

Chelese Ransom, Financial Health Institute

Cherese Scott, Partner Colorado Credit Union

Adnan Syed, volunteer and former Impact Manager with PHCI

Cami Tam, Heart and Hand Center

Billy Williams, New York Life

Shawn Young, Financial Health Institute

Implementation

Programming:

The program, in its entirety, is provided as a pilot to a cohort of 10-15 trusted community members through live, online video meetings and asynchronous supplemental videos and training resources.

The program consists of 16, 1-hour sessions divided across 3 modules:

Psychology, history, and trauma;

Personal finance fundamentals; and

Business finance fundamentals.

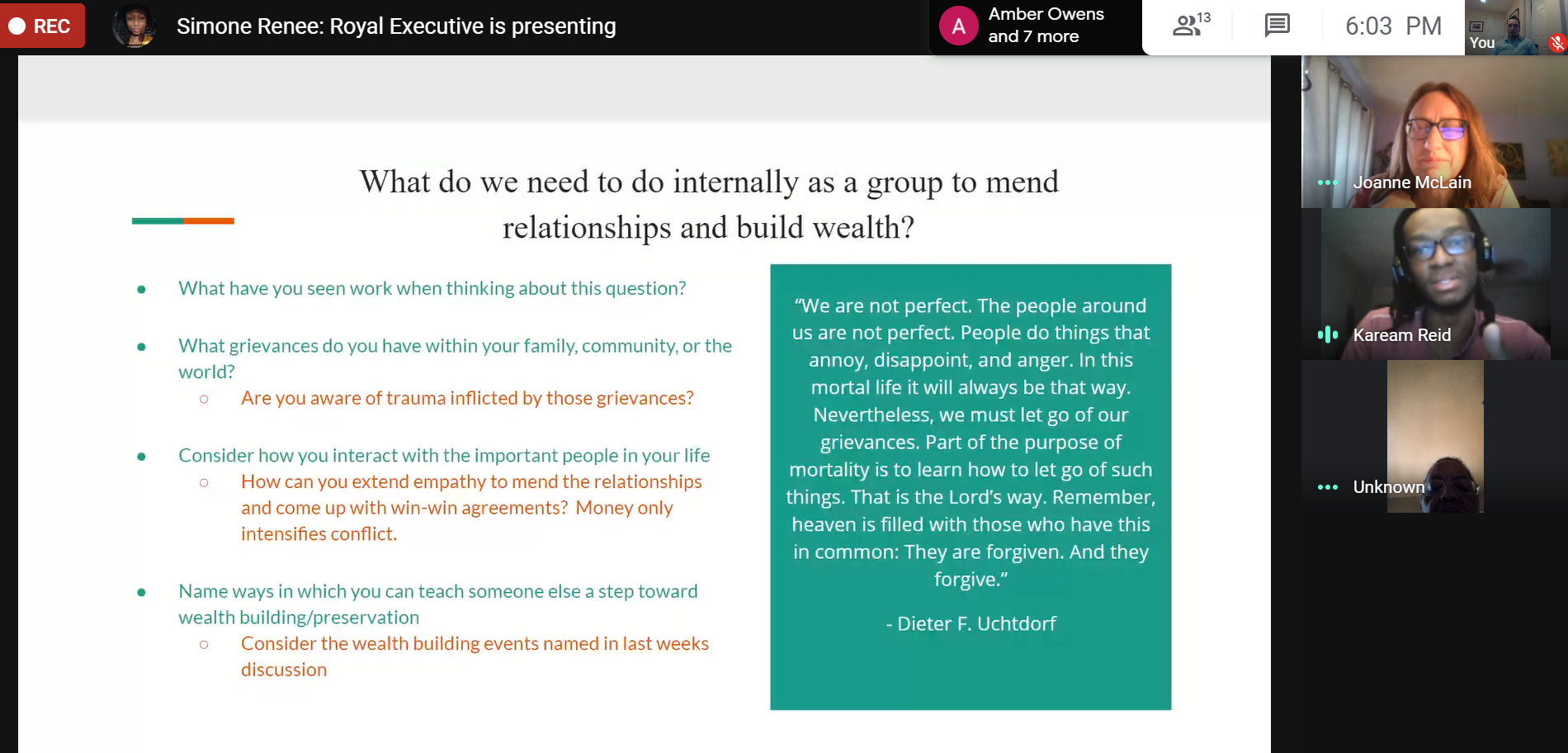

Module 1: Psychology, History, and Trauma

Expert Presenters: Metro Deep and The Financial Health Institute

Come together build relationship / Goal Set - Our individual and collective why

What do we need to be successful and what do we need from others in order to do so?

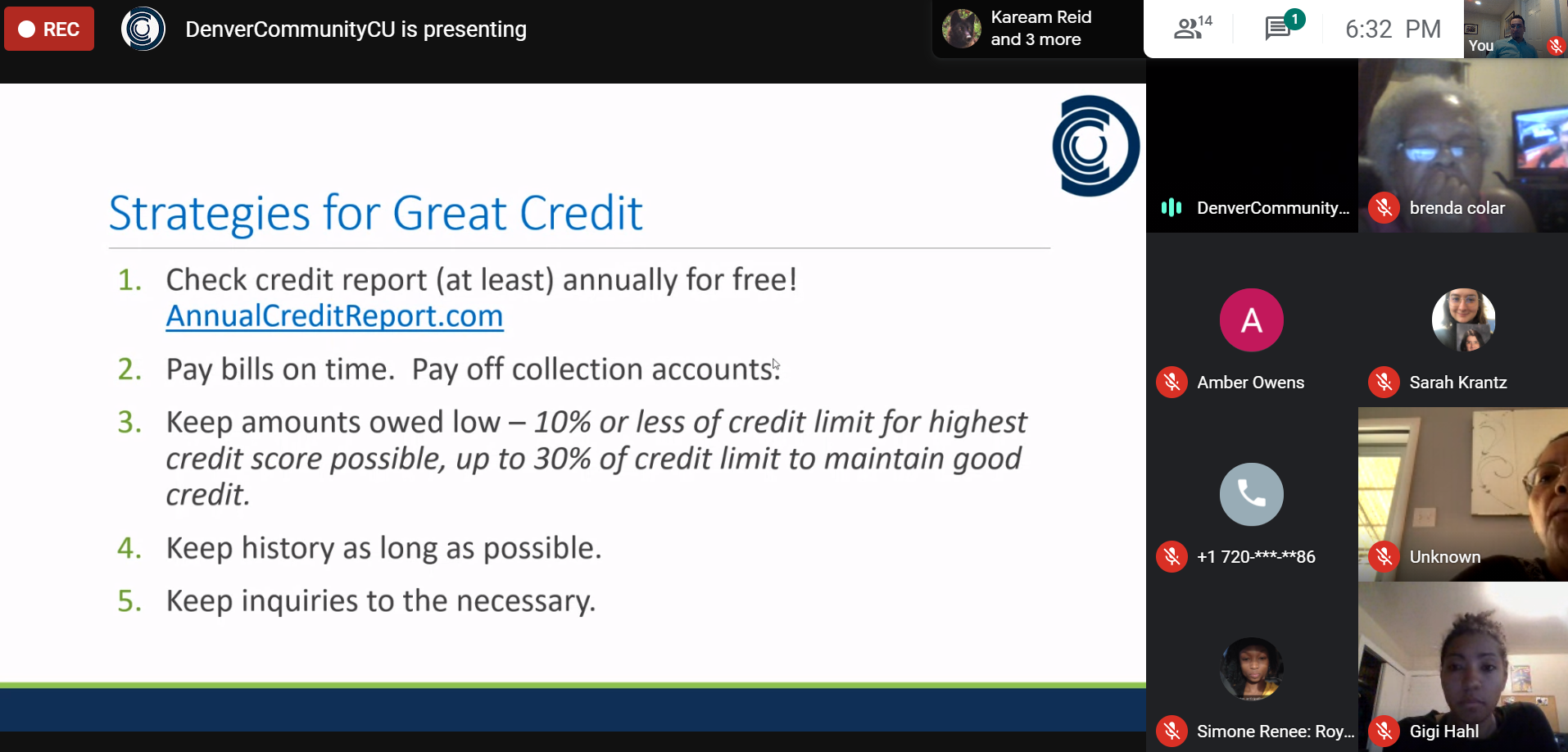

Module 2: Personal Finance Fundamentals

Expert Presenters: Denver Community Credit Union

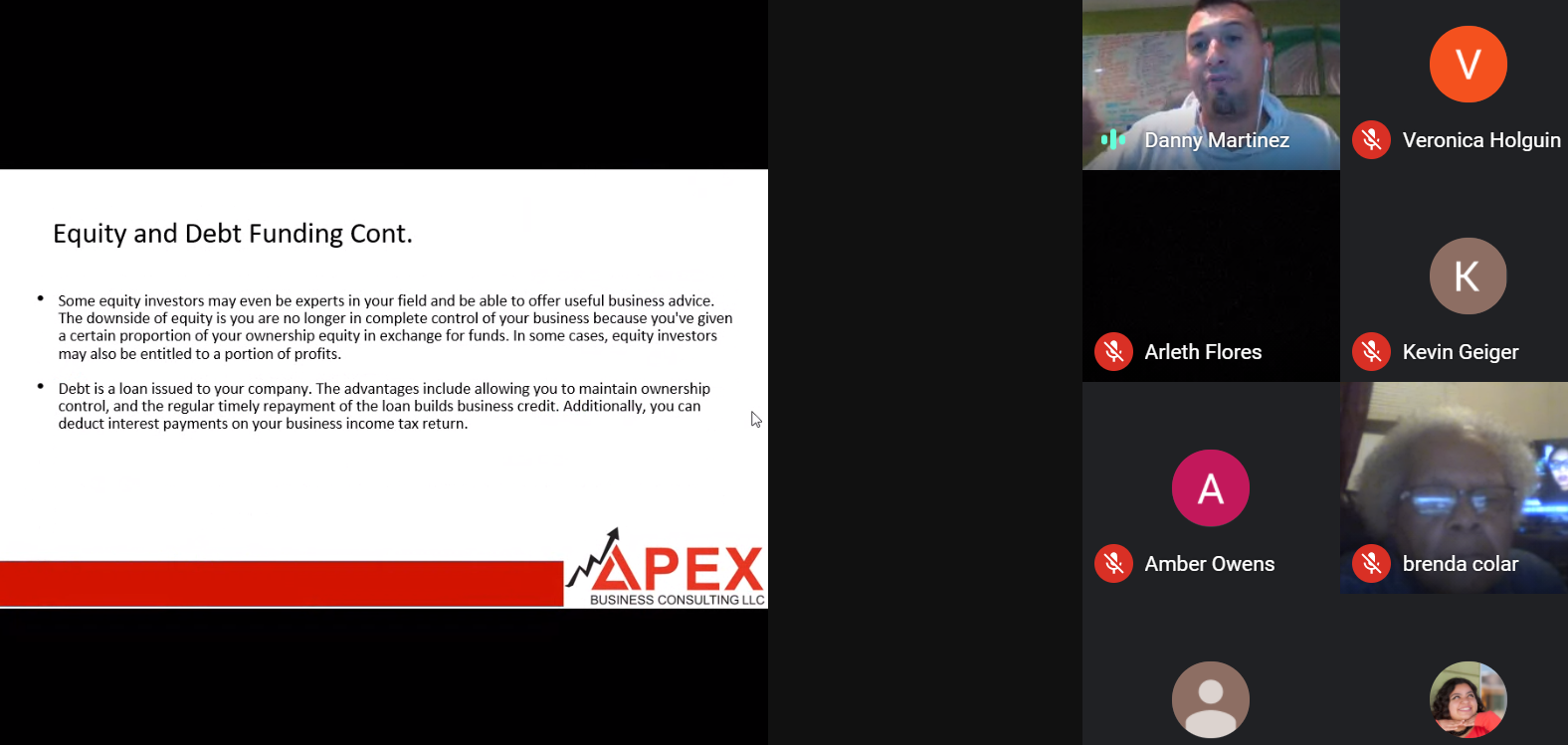

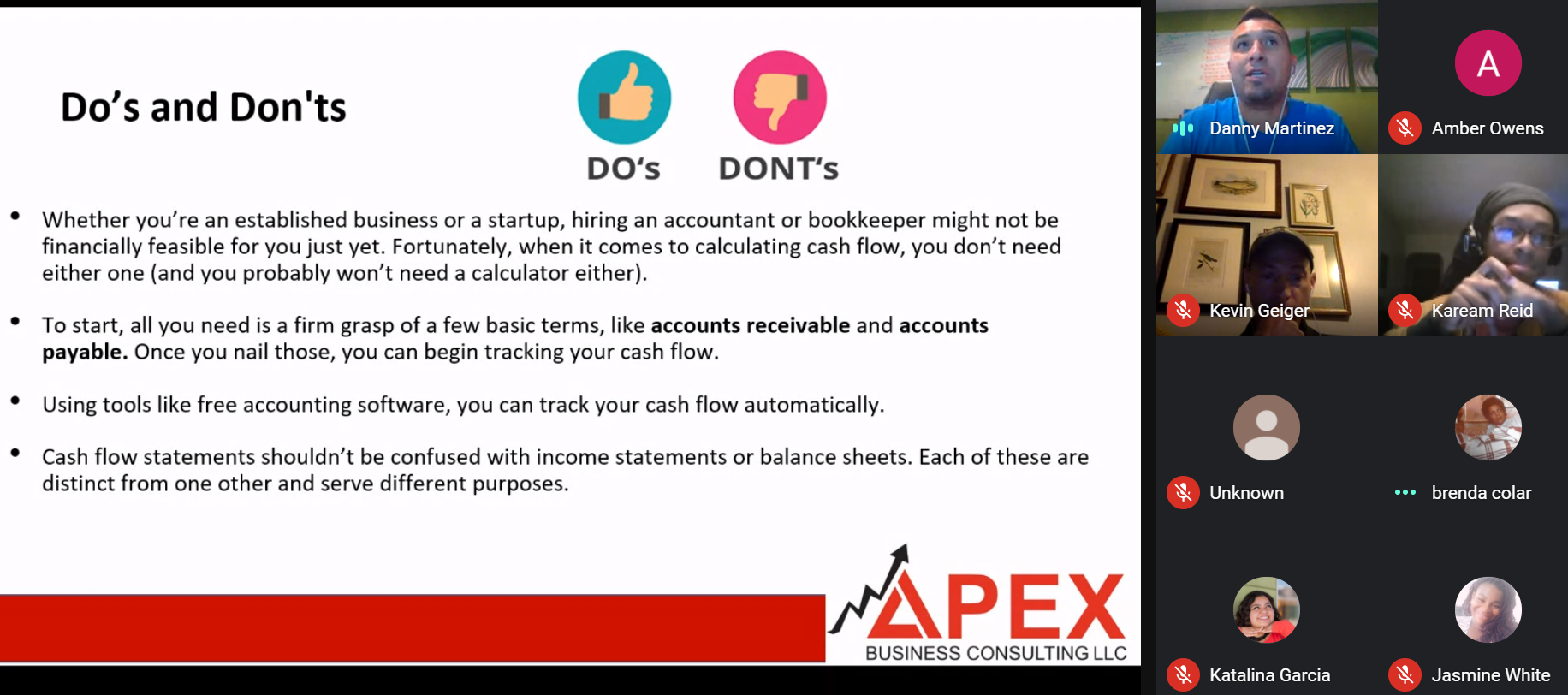

Module 3: Business Finance Fundamentals

Expert Presenter: Apex Business Consulting, LLC

Resources:

To view the slides and resources shared during the program, please click here.

Experts:

The following individuals and organizations developed the curriculum and facilitate the sessions.

Danny D. Martinez, CEO

720-361-8786

Trusted Community Members:

Trusted community members consist of individuals who Live, Learn, Work, Play, or Worship in Park Hill. They support a network of other community members and local small businesses.

Brenda Colar - Lives and Plays

Arleth Flores - Lives

Kevin Geiger - Lives, Plays, and Worships

Veronica Holguin - Works at Love Thy Neighbor (Partner)

Amber Owens - Works, Lives, Plays, and Worships

Clara Owens - Lives and Plays

Kaream Reid - Lives

What we’ve been up to…

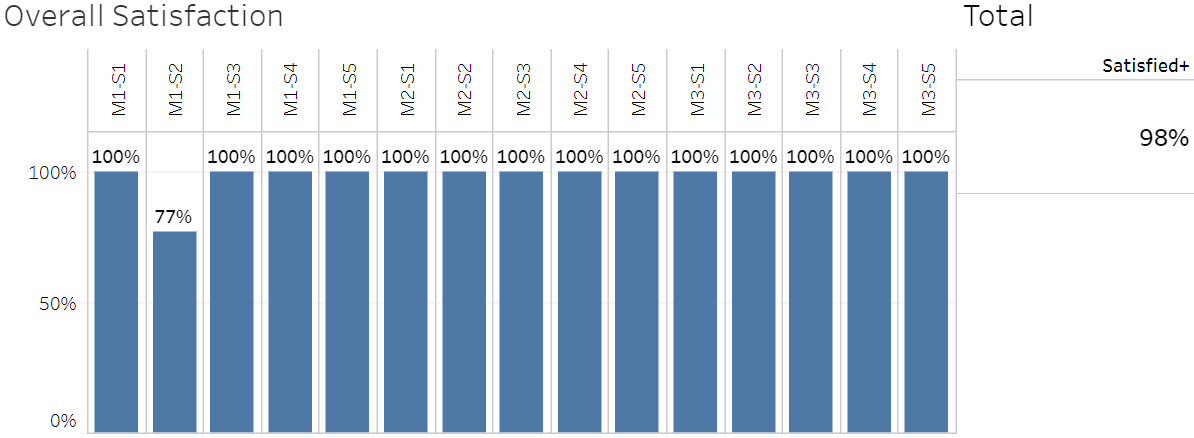

Targets and Goals

Operation and Performance data will be collected and analyzed to evaluate program effectiveness. The instruments detailed below will be the data collection devices via Google forms.

End of Session Surveys - value and satisfaction

Trusted Community Members

Target: 90% positive responses

End of Module Surveys - continuous improvement and satisfaction

Trusted Community Members

Experts

Target: 90% positive responses

End Program Survey - impact and satisfaction

Trusted Community Members

Experts

Target: 90% positive responses

Quarterly Reporting - impact

Trusted Community Members

Experts

Targets:

Average of 4 referrals per quarter

Average greater/equal “Occasional” usage of information, resources, and referrals per quarter